Well, it was a good run.

Fueled by an expanding economy, minimal new supply and an inbound travel contingent that appeared to break visitation records every year, the U.S. hotel industry is just about to finish its seventh straight year of increased room demand.

That could end next year. PricewaterhouseCoopers (PwC) in late November lowered its 2017 U.S. revenue per available room (RevPAR) growth forecast to 1.7% from its May forecast of 3.7% and from its estimate for 2016 of 2.9%. As it is, this year will be the slowest in terms of demand growth since RevPAR plunged 17% in 2009.

And, in fact, PwC might still be overly optimistic.

Where do we start? Why not with January’s inauguration, when Donald Trump is slated to take up residence in the White House. Trump’s hospitality background notwithstanding, his incoming presidency raises a lot more questions than answers. Inbound international travel? Combine Trump’s questionable reputation overseas, his vow to tighten border security and his November phone call to Taiwanese president Tsai Ing-wen (raising serious concerns within China’s leadership) with a dollar that continues to strengthen against both the euro and British pound, and that hints strongly at fewer travelers from overseas.

That doesn’t bode well for gateway cities like New York and Miami, whose occupancy and room-pricing levels are already being constrained by increased room supply (though Houston and the other oil- and natural resources-driven markets that have been taking a beating might get a reprieve with the new administration’s policies).

Cuba? Sure, Marriott International has a property there via the Four Points by Sheraton that was opened under Starwood Hotels, but how much more will the world’s largest hotel company or potential entrants such as Hilton Worldwide and Hyatt Hotels invest in that expensive and cumbersome process if U.S. travel agreements with Cuba are at risk?

And Trump Hotels’ millennial-targeting Scion brand that was announced earlier this year? Details were scarce at the time of the announcement, and with all the static surrounding the president-elect and how he’ll interact with his companies, no further developments are expected any time soon.

Then there’s Airbnb and HomeAway. Airbnb continues to grow and innovate rapidly, garnering a near-rabid following among its largely millennial user base and persuading older and more business-oriented travelers to join the party. By next year, the company will also offer in-destination excursions in 50 cities and may add flight-booking services on its site, further broadening its already-impressive reach. Meanwhile, competitor HomeAway is sure to benefit via exposure, technological advances and marketing punch with a full year of ownership by Expedia under its belt.

As for legal challenges from cities such as New York and San Francisco, Airbnb head of global policy and public affairs Chris Lehane said in November that U.S. cities collectively missed out on $200 million in occupancy taxes in 2015 alone, and that might be conservative (how often do business owners over-report revenue for tax purposes?). So while Airbnb may have kowtowed a bit with its settlement with New York earlier this month, let’s just say some of the other cities that have challenged the company might be more willing to come to the bargaining table with Airbnb and its willingness to remit taxes on behalf of its hosts if the economy has a hiccup and other sources of city revenue begin to shrink.

Meanwhile, travelers who’ve grown accustomed to hotels’ lenient cancellation policies are also in for a letdown. Hilton Worldwide is among hoteliers that are testing cancellation fees, and as more hotel operators feel the pinch, they will tighten their policies, as well. (Airbnb takes full payment up front, and most of its cancellation policies involve the host keeping some of the payment in the event of a last-minute cancellation. It clearly has worked out for them.)

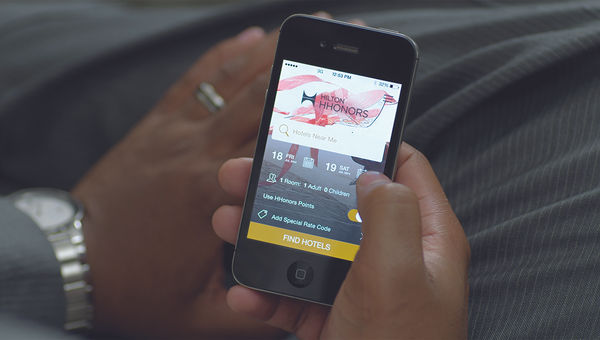

Hilton continues to spend much of its marketing efforts trying to get its loyalty members to book direct.

So where’s the silver lining? For travel professionals, two things jump out. First, those tightened cancellation policies will make the relationships top travel agents have fostered with upper-end hotels all the more valuable, as many agencies can get their guests off the hook if travel plans change. Meanwhile, those hotel companies that have spent much of their marketing efforts in the past year or so goading travelers to avoid OTAs and book direct will probably redirect some of their love to the agency community as those online bookings start to ebb.

Then there’s technology, which is almost always a good thing. Hilton continues to broaden the availability of mobile check-in and keyless room entry via mobile devices at its hotels, as did Starwood before the Marriott buyout in September, so expect the availability of that feature to explode across markets in the U.S. and Europe. More hotels will also start to offer “choose-your-room” options, especially for loyalty guests, with potential up-charges for the most attractive rooms, a la airline seats.

And while improvements in GPS and location-based technologies can induce an Orwellian sense of paranoia for some, they’re great for the hospitality industry, as travel-technology developers continue to devise ways for hotel management to customize service offerings or stave off the type of travel snafus that can ruin vacations.

Speaking of Marriott’s Starwood acquisition (now referred to by some in the industry as “Marwood”), the company may insist that it will keep all 30 brands, but don’t believe it. Marriott says existing contracts with hotel owners prevent the company from shedding badges, but those contracts eventually expire and can also be renegotiated. Expect Starwood legacy brands Element and Le Meridien to be the first to go.

Those benefitting from these predictions can buy this reporter a drink at the Bahamas’ Baha Mar megaresort. Which will finally open in 2017. We think. They say. Well, maybe.

Danny King is a senior editor, covering hotels and hospitality.