Preview 2013

Travel Weekly's Editor in Chief, Arnie Weissmann, spoke to executives about their outlook for 2013. Click here to read.

And Travel Weekly's staff writers looked ahead to 2013 in several industry sectors:

The travel industry is poised for a good year in 2013. The industry's engines aren't firing perfectly on all cylinders just yet, but they are purring well enough to meet demand, maybe exceed expectations, and make a profit.

Unfortunately, the major players can only go so far to make it happen. As always, they're going to be at the mercy of external events: global oil prices, macroeconomic forces, Middle Eastern geopolitics, U.S. government policy, European monetary policy, storms and all the rest.

In short, if 2013 turns out to be a bummer for travel, it very likely won't be the industry's fault, because travel companies have spent the better part of the recession taking care of business.

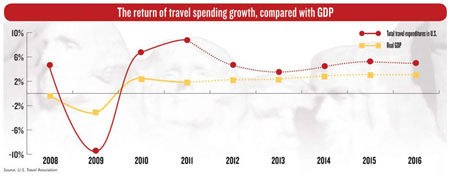

And consumers have responded. Spending on travel by U.S. residents bounced back to prerecession levels in 2011, and it is estimated to have risen 4.3% in 2012, according to the U.S. Travel Association, which is forecasting another 3% rise in 2013, outpacing the expected growth in the economy at large. The increase is even greater when expenditures by foreign visitors is included (see chart).

And consumers have responded. Spending on travel by U.S. residents bounced back to prerecession levels in 2011, and it is estimated to have risen 4.3% in 2012, according to the U.S. Travel Association, which is forecasting another 3% rise in 2013, outpacing the expected growth in the economy at large. The increase is even greater when expenditures by foreign visitors is included (see chart).

The good news is not hard to find.

Airlines have been cleaning up their acts and their balance sheets, and the last of the Big Three airline bankruptcy restructurings is nearing its final act.

The hotel sector, after being slammed by the recession and a drop-off in business and convention travel, is trending up as demand, room rates and occupancy rates continue to rise.

Cruise lines, which had the Wave pulled out from under them by the Concordia disaster, are regrouping with enough confidence to place orders for new tonnage.

River cruise operators are expanding rapidly to meet burgeoning demand for itineraries new and old, and tour operators have refined and streamlined their products to appeal to a broadening spectrum of clients.

The product is good, and retailers consistently report that people are buying and booking further out, a sign they're not waiting for bargains and are buying with confidence.

And on the corporate side, a recent American Express survey revealed that a majority of senior finance executives anticipate spending the same or more on business travel next year, an indication that corporate travel managers are generally optimistic about getting a return on their business travel dollar.

Consumer confidence, in fact, is at a four-year high, according to the Conference Board, which recently reported that its monthly index rose again in November, to 73.7, the highest level of consumer confidence since February 2008.

The Conference Board's index of leading economic indicators also turned north in October, presaging "modestly expanding economic activity in the near term," the board said.

The key word there is "modestly."

The Federal Reserve's latest survey of forecasters puts the consensus projection of growth in gross domestic product (GDP) at 2% in 2013, 2.7% in 2014 and 2.9% in 2015. The unemployment rate, though it has been falling slowly but steadily, is not expected to drop below 7% until at least 2014. For 6.5%, wait another year.

The recovery, in short, is still fragile enough to break, which brings us to the fiscal cliff.

As of this writing, Congress and the White House still have a chance to avoid the automatic tax increases and severe spending cuts that are programmed to begin on Jan. 1. The real question, however, is not whether the government avoids those automatic events, but how.

There will almost certainly be tax increases and spending cuts. Their exact size and nature, and how they are perceived on Wall Street and Main Street, will determine how hard we land.

The Global Business Travel Association has estimated that if we go over the cliff, the result could be a reduction of $20 billion in spending for business travel over nine quarters.

But even if we avoid the cliff, the impact of government austerity measures could still have an impact. U.S. Travel and the American Hotel and Lodging Association have warned that aggressive cuts in government travel budgets, or caps on per diem allowances for government travelers, could compromise federal workforce efficiency and impair the job-creating power of business travel and meetings.

Airlines also warn that the administration's proposed taxes on aircraft departures would add to airline costs and possibly lead to higher fares and reduced demand.

More broadly, some experts have warned that limitations on the home mortgage interest deduction could seriously rattle the housing market. A decline in housing prices could, in turn, deal a blow to consumer confidence if it reduces homeowners' sense of their net worth.

But barring psychological shocks such as these, or disasters of other sorts, there is every reason to believe that travel and tourism has found its way out of the recession and will continue moving on -- if only the rest of the economy would come along for the ride.